How to Void a Check and a Certified Check

There are several reasons to void a check. If you are writing the check and you make a mistake that will cause the recipient to have trouble collecting it in cash or depositing it, you may want to void it and start over. Errors such as writing the wrong date or the wrong amount on the check are good reasons to void it and write a new one.

Another reason to void a check is when your employer wants a blank one to deposit money into your bank account or if you have made arrangements with a membership-based company, such as a gym or club, to debit your account automatically. Here are the steps to void a check.

You can also set up a Pawnshop business.

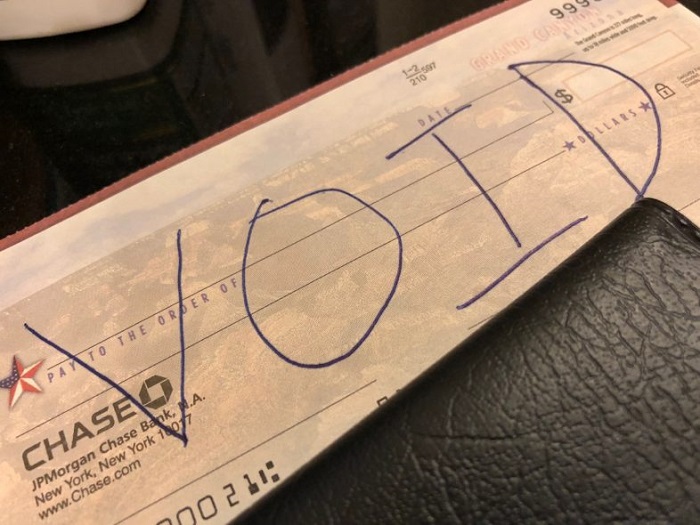

How to void a check?

Write “null” in the amount box on the check. This is the first place a cashier looks to determine the amount for which it was written. See “void” written in the amount table, automatically informs the bank that the check is void.

Write “null” through the signature line. This helps prevent anyone from falsifying your signature on the check. Without an authorized signature, a check is useless. Writing the word “null” through the signature line makes the check also useless and thus prevents counterfeiting.

Write “null” through the center of the check-in large letters. It is preferable to write the word “null” through the dollar amount, a place that the bank teller looks to verify that the amount on the check is correct.

Write “null” on the back of the check. Even if the face of your voided check has been altered and forged, if you write “void” on the back of the check, you will go one step further to ensure that the bank is not going to withdraw money from your account.

Finalization

Make an entry in your checkbook with the voided check number. To keep abreast of it, you must register its number in your checkbook, along with the date and the reason why it was canceled.

Using one or all of the above methods, it is enough to void a check. If you want to make sure that a blank check you submit for business purposes will not be misused, you can call the bank and put a check payment suspension. The suspension of payment will be valid for six months. The bank will also charge you a fee.

If you wish to void a check after giving it to someone and then changed your mind, you need to call the bank to arrange a suspension of payment. If you want to make sure that nobody gets a blank check that belongs to you, you may want to shred it.

Void a certified check

Certified checks, unlike official or cashier’s checks, are checks that are issued from your own bank account. One of your personal checks is certified when a banker approves it, marks it as a certificate and applies a hold on your account that is equal to the amount of the check. In order to void most personal checks, you just have to write a cross by voiding the check. To void a certified check, you must take it back to your bank.

Step 1

Locate your certified bank check and take it to your bank. Explain to a cashier that you need to reverse the certification of your check. Turn the check over the endorsement section and write “Do not use for the intended purpose.”

Step 2

Show the check to the cashier along with a personal identification form, such as your passport or driver’s license. The cashier should check your account to ensure that the check has not been submitted for payment electronically, as some vendors scan the checks and then return the physical check to the issuer. After the cashier verifies that the check has not been submitted for payment, you must write “voided” in large letters throughout the check.

Step 3

Give the check to the cashier as banks must keep the certified checks void. The cashier will release the withholding that was made in your account to cover the amount of the check. Ask the cashier for a printed account or receipt with your balance on it, so you can make sure that the funds have been returned to your account.

Reference:

Average Rating