What is equity in your home and when might you want to transfer it?

If you own your own property, you may well have equity in your home, and there are certain circumstances in which you may wish to transfer it. Here we take a look at what equity is and when you might wish to carry out a transfer of equity.

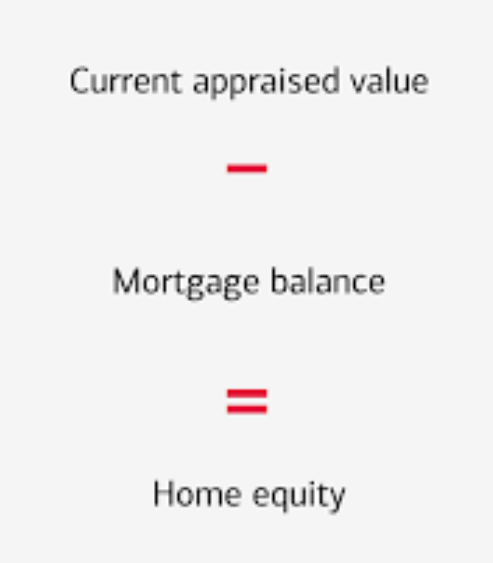

How to calculate your home equity

To assess the equity you currently have, simply do a quick calculation. Add your outstanding mortgage to any secured loans against the property and then subtract this sum from the current value of your property. Always remember that there is such a thing as negative equity which means the value of the property is less than the outstanding mortgage and any secured loans. This often occurs when property prices fall.

When might you wish to transfer equity?

A transfer of equity is a change in the co-ownership of a property and there are a number of circumstances in which you may wish to alter the ownership. For example, if you have married or remarried, you may wish to include your new spouse on the title deeds of the property you own. Alternatively, you may have divorced and wish to remove your ex-spouse’s name from the deeds.

If you co-own a property, and that is often the case nowadays, you may wish to buy out a co-owner’s share if they are thinking of moving out and going their own way, or alter the percentages of the current ownership. Remember, there may be tax considerations such as inheritance tax or personal capital gains.

What is the process?

You will find details of the process online but are strongly recommended to seek legal advice. If you want to understand what costs are associated with the process, you will also find this during your online search at sites such as https://www.samconveyancing.co.uk/news/conveyancing/transfer-of-equity-process-3894.

So, how does the process unfold? First of all, you will need a copy of the title – this will enable you to check any mortgages or charges attached to the property. Your legal representative will then check the deeds, confirm the identities of the parties and prepare a deed of transfer.

If there is a mortgage you will require the consent of the lender before going any further. Should they not agree, perhaps because they doubt the transferee can make the payments, you will have to pay off the mortgage, perhaps by finding a new lender.

If there is no mortgage the process can go ahead, although a stamp duty certificate is required if the transaction exceeds £40,000. The area of Stamp Duty Land Tax is extremely complex and you should make sure you have advice on this matter.

Average Rating